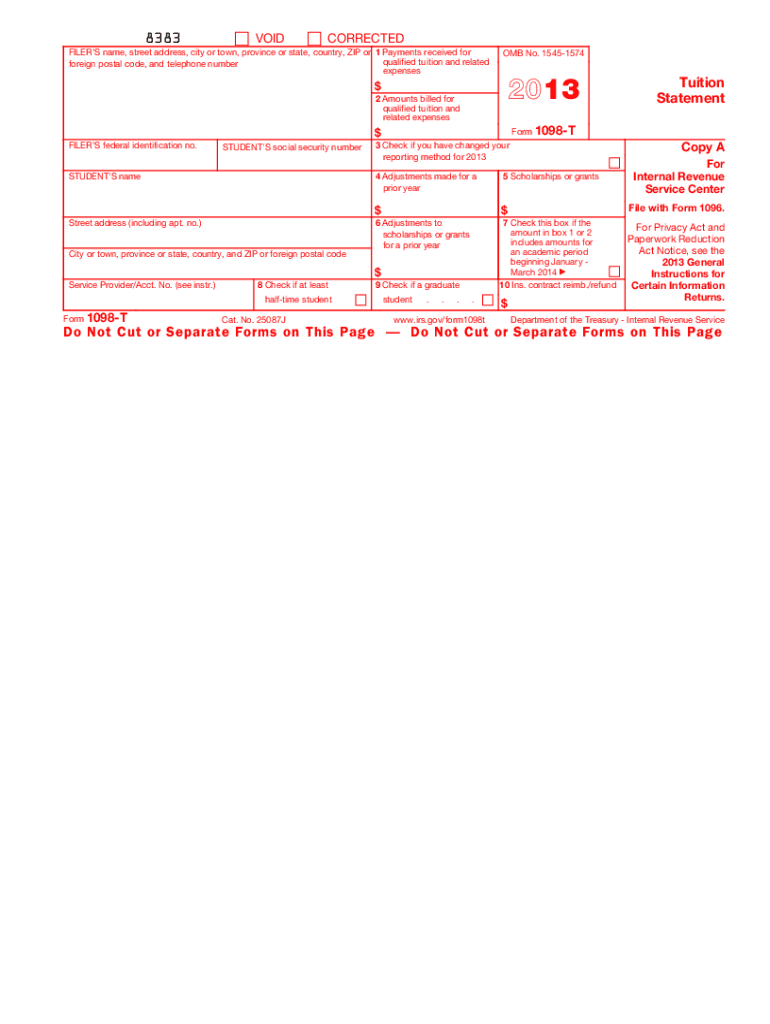

To request a 1098-T form, please visit the Bursar’s Office with a copy of your Social Security Card or ITIN Number. International students must request a form, if needed. In accordance with the Internal Revenue Service requirements, FIU reports amounts. The information reported on Form 1098-T helps students evaluate their eligibility for certain federal tax benefits. The University does not automatically generate 1098-T forms to International Students. The Form 1098-T reports payments applied to qualified tuition and related expenses during the calendar year for which they receive academic credit. If you are not a current student and need a copy of your 1098-T, please contact the Bursar at or call (609) 896-5360. To claim your benefits, you will need a 1098-T form. You may print the form for your records through your browser. Because youre attending college, you or your family may be eligible for higher education tax benefits.

#1098 T FORM DOWNLOAD#

The form is available as a PDF, and students can download or print their. Due to a change to institutional reporting requirements under federal law, beginning with tax year 2018, we will report in Box 1 the amount of QTRE you paid during the year. Indiana University delivers IRS Form 1098-T (Tuition Statement) electronically. Claiming education tax benefits is a voluntary decision for those who may qualify. There is no IRS requirement that you must claim education credits. There is no need to attach Form 1098-T to your tax return. This form is designed to help families, and their tax preparer, determine their qualification for either the Hope or Lifetime Learning Credit or qualification for a tuition and fees deduction on their annual income tax.įor further details, please visit consult with your tax accountant.ĬHANGE NOTICE: In previous years, Rider University reported your 1098-T based on a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) we billed to your student account for the calendar (tax) year. The IRS Form 1098-T reports amounts paid of qualified tuition and related expenses, as well as other related information. The IRS Form 1098-T is a tax information statement required by the Internal Revenue Service (IRS). The 1098-T is prepared by Heartland ECSI, and their website allows former students to view both the current years form and those for prior years.

0 kommentar(er)

0 kommentar(er)